My husband proposed to me on December 8, 2001 after a fun filled day Christmas shopping in the city. He brought me back to the place we met, and sang me a song that he practiced for weeks on the piano.

After a whirlwind month of Christmas gatherings and parties, we started to search for a house to move into. Before we decided on colours, before we decided on the menu for the wedding reception and before I even went wedding dress shopping, we got in touch with a realtor and began the hunt for the place we would move into after our wedding.

I remember looking at many, many different houses. None of them were perfect.

So we chose the one that checked off the most boxes:

- close to downtown

- near an elementary school

- large backyard

- at least 3 bedrooms

When choosing our first home, we did consider the future and what space we would need for the family we wanted to have. Did wanting (or not wanting) a family contribute to your home choice? Did you feel that you could afford owning a house AND having a family?

The pitter patter of little feet around the family home is fast becoming a financial luxury, as more than half of Canadians feel they cannot afford both family life and home ownership.

While we all know that kids are expensive – some say it will cost a quarter of a million dollars to raise a baby to college-age! – it is sad that Canadians feel like they have to choose between owning a home and having a family.

The Terrible Money Twos survey by RateSupermarket.ca polled 1,700 Canadians on their family affordability sentiments. In fact, 54.5% of those surveyed said the cost of having kids was higher than they expected. Did any of the costs of raising kids surprise you?

Some other highlights from the survey were:

- 54.5% said family costs were more than they anticipated

- The price of food topped the list of unexpected costs for parents at 26.5%

- 52.8% of respondents say they cannot start or expand their family in their current home

- 49.4% of respondents say they have changed their minds about their desired family size due to associated costs

- 71.4% of millennial respondents say they would need to make significant financial changes before starting a family, lead by increasing savings at 41%

At the time when we purchased our home, our credit union was the place we went for our mortgage. Because of mortgage rates back then, it didn’t make much difference or sense to compare to find teh best mortgage rate with different financial institutions or mortgage companies.

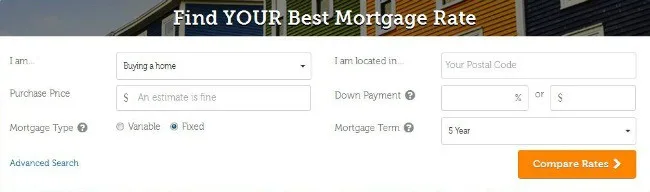

Now, with current home prices and different mortgage companies, it is more important than ever that would-be homeowners compare their mortgage options. With tools such as RateSupermarket.ca’s Best Mortgage Rate Calculator, you can find the best mortgage rate for you!

Did you shop around for a mortgage rate when buying your first home? Did you have to “choose” to have a family or own a family home?

This post was brought to you by Ratesupermarket.ca

You can sign-up to get an email update each day. You can also connect with us on:

Cheryl

Thursday 10th of December 2015

Great breakdown in the cost of kids!! Hope it helps people open there eyes and realize before they come on board!! So important to save money where you can and a mortage rate is a great place to shop around.

Nicole a

Thursday 10th of December 2015

I used this resource to help me negotiate a better rate last spring!

Chasing Joy

Friday 4th of December 2015

This is a really interesting survey. I am trying to conceive now and I am also saving money for childcare. That cost scares me the most.

When I purchased my house I thought I'd only be in a few years then I'd get married move with my husband and use the property as a rental. Ha!!! LIfe has taken a very different route I am still in the same home and preparing to have a little one (God willing) while still living here.

christina aliperti

Friday 4th of December 2015

My mom is going to be buying a house soon. She is in the process of doing all the research now and getting preapproved for a mortgage. It's a very long process and a learning process as well.

Tracey

Friday 4th of December 2015

What an awesome resource! It is great to be able visualize expenses and how to plan for them.